Published: 06-Jun-2022

Let me tell you a kutti story about the very valid point Chandra is making.

A few weeks ago, Dad gets call from Aditya Birla Finance one day asking him to pay his due amount. He was surprised since he didn't have any loan. This goes on for 3-4 days with them calling multiple times a day, even during office hours.Dad assumes they are a scam and tells them sternly not to call. But they continue.

He ropes me in to check. Given the whole ghost loan drama that was happening, I pull his credit report to check.And there it was. A ₹31,500 loan from Aditya Birla in his name in the credit report. What's more interesting though was only ₹550 was due.Not just this, there were two other loans - one from Karur Vysya Bank (28,000 total, just 719 due) and another from Capital Float (7,000 total; just 68 due).

I immediately presume someone has taken ghost loans using dad's details. But bless him/her, they have been paying back and only the last month dues are left for all the loans. But this story didn't make sense. So I continue digging deeper

A clue that stood out wad the Account number of Aditya Birla loan started with the alphabets 'PYTMPPABFLXXXXX'. I immediately check if Dad had a Paytm payment Bank account. He didn't. The next obvious alternative was some pay later scheme by Paytm. We dig into the app further and find Paytm Postpaid. And there it was - a due of ₹550. And there was another detail that confirmed we were on the right track - Paytm Postpaid limit: ₹31,500.

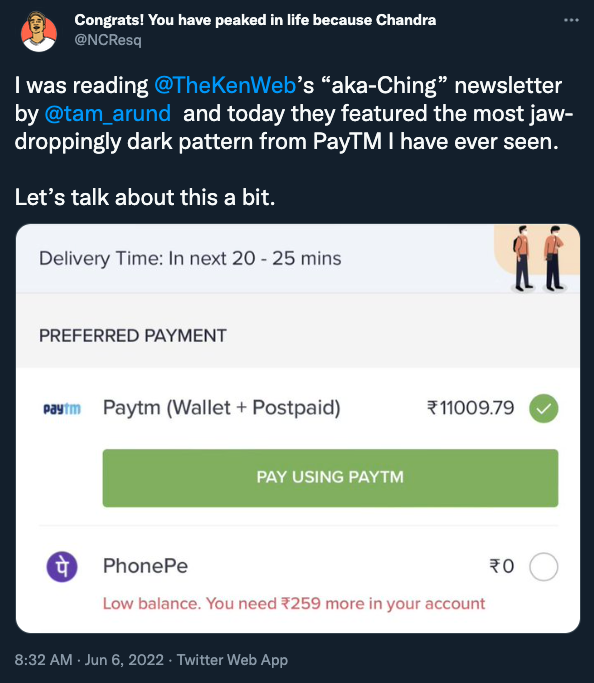

My dad had no idea when he used Paytm Postpaid. The only guess I can make here is that one of the payments he thought he was making via wallet/UPI was slyly slipped into postpaid. Like in Chandra’s screenshot shared at the beginning of the post. And due to this dark pattern by Paytm, he got 10+ loan repayment calls from Aditya Birla.

The next part of the puzzle were Karur Vysya and Capital Float loans. From my limited knowledge, options were Lazypay, Simpl and Amazon. The account number of both these loans began with 'ANAxxxxxx'. So I tried Amazon pay first.

Bingo! Dad had a due of ₹787 in Amazon pay later (719 + 68). And a credit limit of ₹35,000 (28,000 + 7000). Again, no idea how this happened. My guess is one of the checkouts got defaulted to Amazon pay later and he didn't notice.

He's 61 years and not a digital native. I don't think he's going to notice the modern designer's beautiful but subtle suggestions that the option is a BNPL. But he's definitely going to continue using Amazon and Paytm because he finds value there.

The design for BNPL push has to change. Or better yet, don't push BNPL.